sss er and ee|SSS Contribution Table for Employees and Employers : Clark SCHEDULE OF SOCIAL SECURITY (SS), EMPLOYEES’ COMPENSATION (EC), AND WORKERS’ INVESTMENT AND SAVINGS PROGRAMS (WISP) CONTRIBUTIONS. . loira praiana oficial (@loirapraianaoficial) | TikTok. Casal Praiano | TikTok. Instagram. Youtube Loira Praiana Oficial. Youtube Casal Praiano Oficial. Youtube Dona Angélica .

sss er and ee,Simple Terms Used on the Table: *ER means Employer's Contribution. *EE .

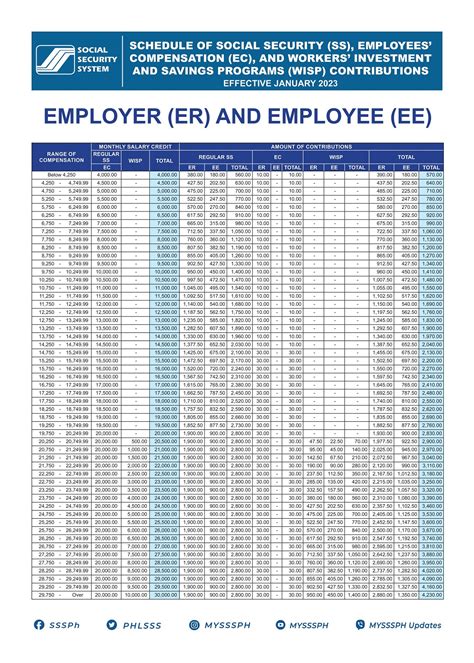

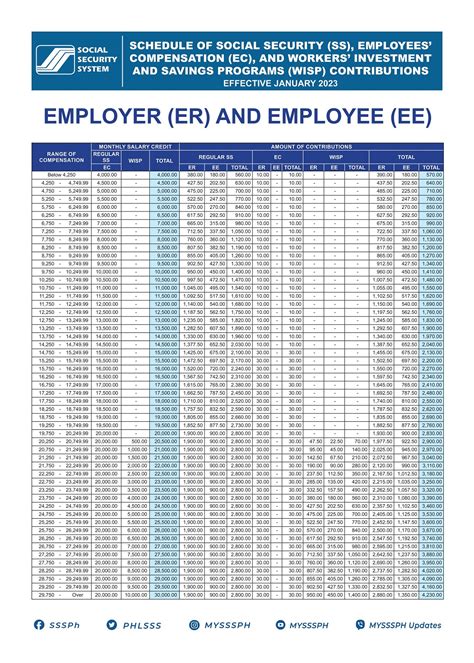

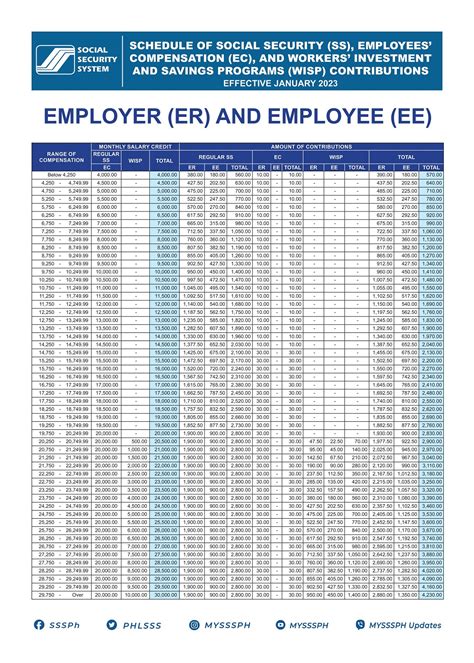

effective year 2023, the new schedule of contributions of ER and EE is hereby issued and shall be effective for the applicable month of January 2023 as per Social Security .SCHEDULE OF SOCIAL SECURITY (SS), EMPLOYEES’ COMPENSATION (EC), AND WORKERS’ INVESTMENT AND SAVINGS PROGRAMS (WISP) CONTRIBUTIONS. . Who Can Pay SSS Contribution? Why Pay Your Contribution Regularly? How To Compute Your Monthly SSS Contribution: The Basics. The New SSS Contribution Schedule. The 2023 SSS Contribution . Maximum Monthly Salary Credit (MSC) increases to P25,000. The SSS Circular No. 2020-033 was then issued to announce the new schedule of contributions for employers (ER) and employees (EE) which .

Dis 17, 2020

Employer (ER) An ER is any person who uses and pays for the services of another person in any business, trade, industry, or undertaking. Employee (EE) . What is EE and ER in SSS? ER – Employer’s contribution. EE – Employee’s Contribution. EC-ER – Employee’s Compensation Program. SE – Self Employed. What does ER and EE mean? The suffix -er is used to describe a person or thing that does or provides an action. The suffix -ee describes the person or thing that receives the action.

sss er and ee SSS Contribution Table for Employees and Employers SSS monthly contribution computations for employers, employees, and self-employed individuals vary. . Go to the ER column and get your share of the contribution that matches an employee’s MSC. .

effective year 2023, the new schedule of contributions of ER and EE is hereby issued and shall be effective for the applicable month of January 2023 as per Social Security Commission (SSC) Resolution No. 751-s.2022 dated 25 November 2022. The table below reflects the contributions for SS, the Employees' Compensation (EC) and the Workers'

Employer (ER) and Employee (EE) Employer (ER) refers to the entity or individual who hires employees and is responsible for deducting SSS contributions from their employees’ salaries. Employers are mandated by law to remit these contributions, along with their own share, to the SSS on behalf of their employees.With regards to SSS Contribution, the Social Protection System (SSS) must published adenine new news dated December 13, 2022, SSS Circle No. 2022-033 announcing the increase starting social security (SS) contribution rate to 14% starting of month for January 2023 per SSC Resolution No 751-s 2022 dated November 25, 2022.The employee is the recipient of wages or salary for the services rendered. EE is used to identify the employee’s portion of contributions towards various payroll deductions, such as taxes, insurance premiums, retirement plans, and more. ER – Employer: ER stands for employer in payroll. It indicates the organization or company that hires .What are the legal obligations of an Employer (ER) with the SSS? Register with the SS and secure their ER ID Numbers by accomplishing the Employer Registration Form (SS Form R-1). Require prospective Employees (EEs) to register with the SSS and present their SS numbers for reporting to the SSS. Report all EEs for coverage using the Employment .

Republic of the Philippines Social Security System

The contribution rate for SS will increase to 14%, the minimum Monthly Salary Credit (MSC) to P4,000, and the maximum MSC to P30,000.00. However, this new schedule will be applicable to both Employers (ER) and Employees (EE) and will include contributions for Employees’ Compensation (EC) and Workers’ Investment and Savings Program (WISP .sss er and eeIn the sss table of computations what does er, ee, ec stands for? There are ER, EE and EC in the said table . Post to Facebook . Post to Twitter . Subscribe me. Related Discussions: jessahmorales. Level 1 (Contributor) 2 Answers, 2 FollowersTitle. CONTRIBUTION_TABLE_POSTER_15inX21in_March_20_2019. Created Date. 3/20/2019 4:32:57 PM.programs that are administered by sss. schedule of regular social security, employees compensation, and mandatory provident fund contributions employer and employee effective january 2021 range of . compensation er ee total er ee total er ee total er ee total below 3,250 3,000.00 - 3,000.00 255.00 135.00 390.00 10.00 - 10.00 - - - 265.00 135. .Using the new SSS Table, look for the "Range of Compensation" column. Find the corresponding range of compensation of the member's monthly salary belongs to. Step 2. Head over to the "Total Contribution" and look .

ER refers to the “Employer’s Contribution” to benefits. EE is the “Employee’s own Contribution”. VM indicates “Voluntary Members” who are contributing extra funds beyond the required amounts. NWS means “Non-Working Spouses” of Employees who are covered under benefits. SE stands for “Self-Employed” Individuals.SSS Contribution Table for Employees and Employers SSS CONTRIBUTION RATE 2022 – Here is a guide on the SSS monthly contribution for employer members of the Social Security System. Individuals who hire people to work for them are eligible to apply for membership to the Social Security System (), one of the biggest social insurance institutions in the country.They may also have the . For Employers (ER) and Employees (EE) contributing at an MSC of P20,000 and below: Additional monthly SSS contributions range from P40 to P200, which will be paid by the employer only. For ER and EE contributing at the maximum MSC of P30,000: The additional amount of monthly SSS contributions is P950, with P225 coming from the .

For todays, I’m gonna show you the SSS Contribution Schedule for 2023 If you are interested na malaman kung paano ito gawin, please keep watching until the .Starting 2023, new SSS contribution rates will be implemented to provide better benefits for members and ensure the fund's sustainability.

sss er and ee|SSS Contribution Table for Employees and Employers

PH0 · SSS Contribution Table for Employees and Employers

PH1 · Republic of the Philippines Social Security System

PH2 · New Schedule of SSS Contributions for All Employers

PH3 · New SSS Contribution Table Effective January 2021

PH4 · New SSS Contribution Table 2023

PH5 · EMPLOYER (ER) AND EMPLOYEE (EE)

PH6 · EMPLOYER (ER) AND EMPLOYEE (EE)

PH7 · Complete Guide To SSS Contribution, Benefits, & Requirements

PH8 · (2021) SSS Contribution Table for Employees, Self